While much of Europe paused for the summer, emerging markets keep moving. In this edition, we look at the funding trends in both MENA and Europe in H1 2025 (MENA raised 134% more funding YoY), mention a couple of freshly minted unicorns and highlight the changes in the legislation, among other topics.

“For founders ready to expand beyond saturated markets, MENA offers a powerful proposition. From massive, underserved markets like Egypt to high-revenue hubs like the UAE and Saudi Arabia, the region combines scale, speed, and capital. Saudi Arabia in particular, is becoming a base for globally ambitious founders, not just for funding, but for building. Check out our country brief on Saudi Arabia to learn more.”

Magdy Shehata, Founder and CEO at Söderhub

MENA Updates

Saudi, the UAE and Egypt lead startup investments in the region

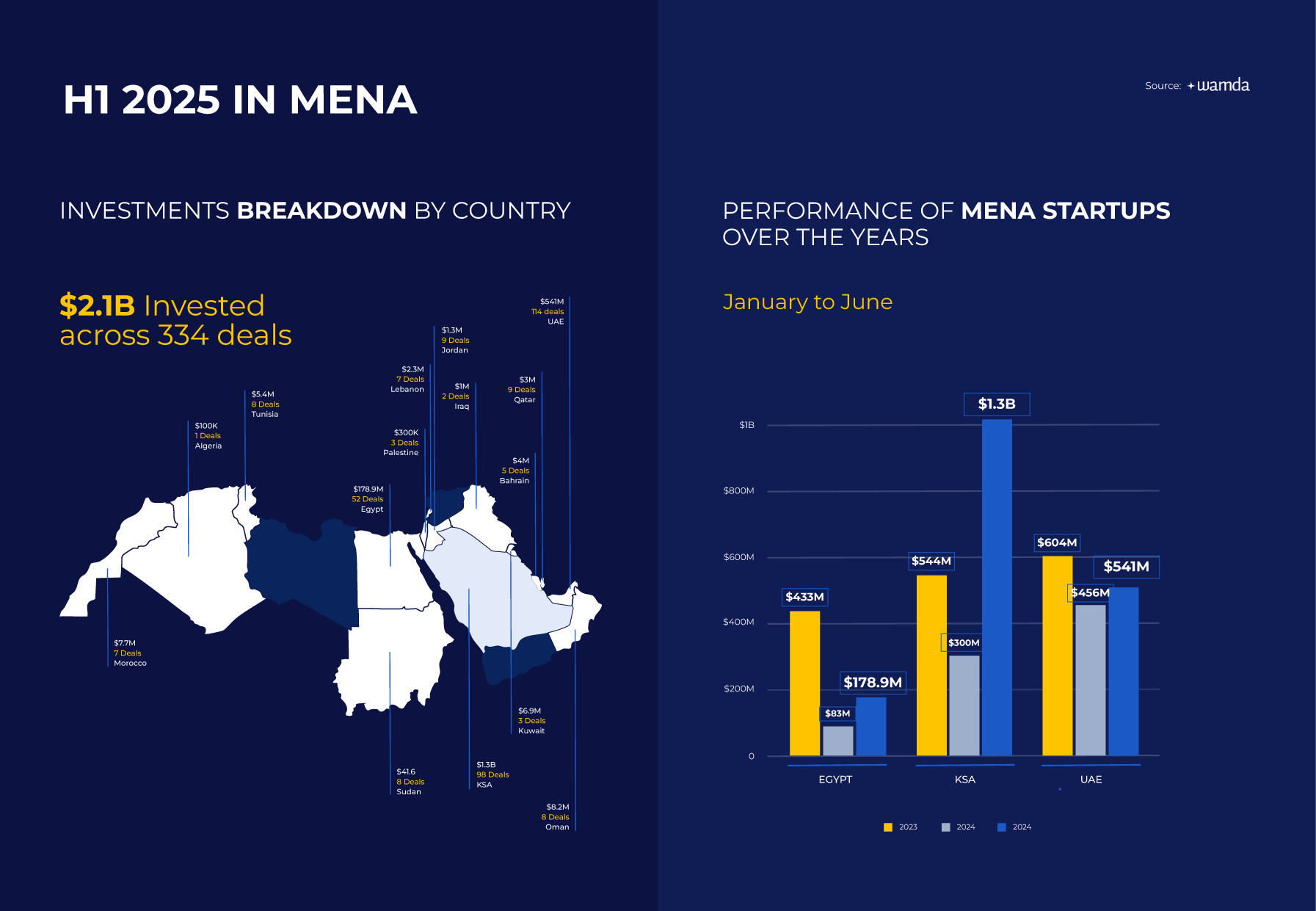

Startup funding across MENA grew to $2.1B in H1 2025 across equity and debt, up 134% YoY, according to Wamda. Saudi Arabia took the lion’s share, raising $1.35B (including $969M in fintech) and accounting for 64% of total regional funding. The UAE followed with $541M across 114 deals, while Egyptian startups raised $179M, a 90% YoY jump, placing the country 6th regionally, up three spots from 2024.

Riyadh climbs 60 places to rank 23rd in the Emerging Startup Ecosystems Index

Saudi Arabia has climbed 60 spots in just 3 years to rank 23rd globally and 3rd in MENA for startup funding, according to the 2025 Global Startup Ecosystem Report by Startup Genome.

Since 2018, over $2.6 billion in VC funding has flowed into the Saudi market. Riyadh is now a top launchpad for startups targeting the $2 trillion GCC market. The Kingdom ranks third globally in funding volume.

Saudi Arabia’s rise is powered by Vision 2030, government-backed funds like SVC and Jada, and programs such as Monsha’at and CODE that streamline regulations and support scale-ups.

Ninja becomes Saudi’s newest unicorn after $250M raise

Groceries delivery startup Ninja has become the Kingdom’s latest unicorn after raising $250M at a $1.5B valuation, signaling Saudi Arabia’s growing startup dominance amid a regional funding surge.

Egypt’s Breadfast reaches $382 million valuation

Breadfast, quick commerce startup, now serves over 300,000 monthly active users with nearly 1 million orders per month, generating $150 million in ARR.

Sweden-based VNV Global has announced that Breadfast is now valued at $382.3 million, nearly doubling the value of its 7.9% stake from $16.9 million in 2021 to $30.2 million today.

AI-powered company building is already here

Remember, we wrote about AI democratising who gets to build a startup? Dubai-based idea-L has raised $1 million in pre-seed funding to launch what it calls an “AI co-founder in your pocket.” Founded in 2024, the startup blends generative AI, Web3 tools, and human mentoring to turn early ideas into investor-ready ventures. Its first product, fast-Feasibility™, offers instant market validation and will debut in private beta.

Foreign startup registrations in Saudi Arabia surge 118%

The Ministry of Investment has issued 550 licenses to foreign startups as of mid-2025, up 118% year on year. These licenses simplify market entry and give access to funding and local networks.

At the same time, Monsha’at has approved 364 licenses for business incubators and accelerators across the Kingdom, part of a growing infrastructure to support early-stage companies.

The spike in Riyadi licenses reflects Saudi Arabia’s broader VC surge, with rising foreign interest and strong state-backed support shaping the region’s most active startup market.

Savvy partners with Side to boost Saudi Arabia’s gaming industry

UK-based Side, a leading voice acting and audio production studio for AAA games, is expanding to Saudi Arabia through a strategic partnership with Savvy Games Group. The company will open a Riyadh studio by Q4 2025, focusing on talent development and making Saudi Arabia a creative gaming hub.

“The way we see it, Saudi Arabia is quite possibly the most important market for the global gaming industry right now, especially when it comes to the development scene,” said Deborah Kirkham, CEO at Side.

This move aligns with Saudi Arabia's Vision 2030 gaming sector investments, potentially establishing Riyadh as a new global gaming capital.

News from Europe

Round-up of investment trends and startup news

A decade ago, Europe was still chasing Silicon Valley. Today, it’s a player in its own right. Since 2014, over €143B has been invested into 26,000 startups, with climate and AI leading the charge.

The ecosystem is diversifying fast, beyond fintech, beyond London and Berlin. ClimateTech now takes 27% of all VC funding, and unicorns are emerging across nearly 30 countries. EU-Startups looks back at the last 10 years of European venture capital.

More recently, startups across Europe raised €23.8B in H1 2025 across 2,143 rounds. The UK remained the best-funded ecosystem with €6.7B, while Germany gained ground with €4.3B after strong activity in defence and deeptech. France followed with €3B, despite a nearly 30% drop. Healthtech was the most funded sector, attracting €5.7B across the region.

EU Startup & Scale-up Strategy is cautiously welcomed by the startup community

The European Commission’s new EU Startup & Scale-up Strategy, part of the Choose Europe initiative, introduces concrete tools to help startups grow and compete globally. Key measures include a proposed 28th Regime allowing startups to operate under a single EU-wide legal framework, a European Business Wallet for streamlined digital compliance (Q4 2025), and expanded regulatory sandboxes via the Innovation Act.

Financing will be boosted through the EIC STEP Scale-Up call (€10–30M equity per company), a new Scaleup Europe Fund for €100M+ deep-tech rounds, and the Innovation Investment Pact targeting institutional capital. Growth is supported by the Lab to Unicorn initiative with standard IP and equity models, while talent attraction will be driven by the Blue Carpet Initiative (harmonizing stock options and remote hiring) and the Blue Card Directive for faster visas.

The Commission will report on progress by the end of 2027. But the message is already clear: Europe wants to be the best place to scale.

Inside Arctic15: startups that were in the limelight

Nordic startup ecosystem is very focused on creating meaningful solutions to humanity’s biggest problems, with 38% of VC funding going to impact startups. This year, the spotlight at Arctic15 was on deep tech: Project Diamant pitched paper-thin satellite antennas, PreMet unveiled a mammogram alternative, and Koll reimagined spam detection. In other tracks, highlights included My!Gamez, bridging Western mobile games into China, and Dribla, whose smart training shoes — backed by Finland’s football captain — bring indoor sports to life.

Funding targets ranged from €50K to €5M.

Biotech’s AI leap faces a compute crunch

European startups are pushing AI to new frontiers in biotech, from simulating brain diseases to decoding biology at scale. UK-based Prima Mente is building an 80B-parameter model to detect early dementia, while France’s Bioptimus is developing a “ChatGPT for biology” to accelerate drug discovery.

But scaling models requires massive infrastructure. Startups like Prima Mente now rely on next-gen compute providers like Nebius to access the GPU power once reserved for Big Tech. In biotech, sovereign cloud and high-performance compute are no longer optional.

Lovable becomes a unicorn 8 months after founding

Stockholm-based AI startup Lovable has joined Europe’s unicorn club after closing a $200 million Series A round led by Accel, valuing the company at $1.8 billion.

Lovable lets users build apps and websites using natural language, attracting over 2.3 million users and, more impressively, more than 180,000 paying subscribers, contributing to $75M in ARR in just seven months.

With just 45 employees, Lovable is tapping into a massive market of non-technical users now responsible for over 10 million projects built on the platform.

Söderhub News

Saudi Arabia: country brief

We’re often asked: “Why work with Saudi Arabia?”

To answer that, we’ve prepared a short briefing on the Kingdom’s macro trends and evolving business environment.

The short answer?

Saudi Arabia combines the scale of emerging markets with the revenue potential of mature economies. With strong public investment, a reform-driven agenda, and growing access for foreign founders, it’s becoming a launchpad for global expansion.

Saudi Arabia is currently the 19th largest economy in the world with a $1 trillion GDP. Foreign direct investment is surging, with $4.26B in Q3 2024 alone, and the Kingdom recently rose to 13th in Kearney’s FDI Confidence Index.

Would you like to learn more? Check out our country brief ⤵️

Events on our radar

Copenhagen, Denmark

27–28 August 2025

Nordics’ leading tech gatherings, bringing together 7,000+ founders, investors, and corporates. A high-energy space to network, served with a side of Danish hygge.

Riyadh, Saudi Arabia

27-30 October 2025

FII9 brings together global leaders to unlock bold solutions, accelerate sustainable growth, and channel innovation and capital toward shaping a better future.

Riyadh, Saudi Arabia

5–8 November 2025

One of Saudi’s largest entrepreneurial events, with 160,000+ visitors. A space for founders, decision-makers, and investors to connect and grow.

Riyadh, Saudi Arabia

12–13 November 2025

B2B conference bringing together Saudi’s top startups, VCs, angels, accelerators, and service providers. 1000+ attendees expected.

Helsinki, Finland

19–20 November 2025

One of the world’s top startup events. Curated crowd of founders, operators, VCs, and media. 13,000+ participants.

Stockholm, Sweden

11–12 February 2026

Where startups, scaleups, corporates, and investors meet. Held at Strawberry Arena with 300+ speakers.

Did a friend forward you this newsletter? Subscribe now!