November may bring dim skies to the Nordics, but autumn in Riyadh marks the most event-dense season of the year — from FII to Biban and a calendar packed with business conferences and cultural festivals (we counted 10 just last week). Against this backdrop, MENA’s startup and public-market activity continues to grow, led by Saudi Arabia and the UAE, deep-tech and clean-energy investments are on the rise in Finland, Swedish AI and biotech companies are posting strong rounds. Here’s this month’s cross-regional pulse.

Table of Contents

NEWS FROM EUROPE

Nvidia invests $1B in Nokia, eyes AI + 6G future

Nvidia invests $1B in Nokia for a 2.9% stake, sending Nokia shares up ~20-22%. The investment launches a strategic partnership centred on AI-RAN, merging Nokia’s wireless-networking infrastructure with Nvidia’s AI architecture to power next-gen 5G/6G networks.

Finland, Q3 2025: clean energy, AI, and quantum computing on the rise

Finland is drawing global investors with $22.2B in green projects, hydrogen and maritime expansions, and a growing AI and quantum ecosystem. Highlights include IQM, quantum computing company, raising $305M; ICEYE, a synthetic-aperture radar satellite imaging company, $9.99M round and Oura’s $11B valuation.

Oura hits $11B valuation with $900M series E

Finnish wearable tech company Oura raised $900M in a Series E, pushing its valuation to $11B. Known for its smart rings, Oura has sold over 5.5M units and is expanding features with AI-powered Health Panels, tracking 50 biomarkers and integrating glucose insights via Dexcom.

Norway’s 1X brings humanoid robots home, and they’ll do your laundry

[Photo: Courtesy of 1X Technologies/Eli Russell Linnetz]

Norwegian-American startup 1X, backed by OpenAI, EQT Ventures, and Samsung, is bringing its humanoid robot Neo, capable of folding laundry, tidying, and doubling as an entertainment system, to consumers for $499/month, with US deliveries starting in 2026, with other markets following in 2027.

The company has already raised $100M and is targeting a $1B round at a $10B valuation, as global funding for humanoid robotics hits $3.2B in 2025, more than the last six years combined.

Sweden’s AI startups triple funding to $504M

Sweden’s AI startups have already raised $504M across 28 deals in 2025, more than triple last year’s $138M. Big rounds from Lovable ($200M) and Legora, which also raised twice: $80M in May; $150M in October, along with rising names like Tzafon, Strawberry, and Normain, backed by General Catalyst and EQT Ventures, are cementing Stockholm as a leading European AI hub, fueled by programs like Project Europe and a number of serial entrepreneurs reinvesting in the ecosystem.

Legora becomes a unicorn after a $150M raise

Stockholm-based AI legal platform Legora raised $150M, valuing the company at $1.8B as it expands to 40 markets and aims to double its 200-strong team.

Stegra aims for $1.1B boost to power Europe’s green steel revolution

Sweden’s Stegra plans to raise $1.1B to complete its hydrogen-powered steel plant in Boden, Europe’s first greenfield mill in 50 years, running entirely on renewable hydrogen, advancing the push for low-carbon steel production.

Thinking Nordic tech would be a good fit for your portfolio?

MENA NEWS

After a record-breaking September, MENA startups raised $784.9M across 43 deals in October. Despite a sharp 77% drop month-on-month from September’s $3.5B surge, funding still remains 395% higher year-on-year.

🇦🇪 The UAE reclaimed the top spot, pulling in $615.7M across 15 deals, powered by Property Finder’s $525M debt round.

🇸🇦 Saudi Arabia followed with $119.3M through 15 transactions, marking a rotation of investor focus back to the Emirates after a Saudi-led Q3.

🇪🇬 Egyptian startups bounced back, raising $33.3M through 5 deals, outperforming their entire Q3 total.

🇲🇦 Morocco held steady for the second month, landing $12.3M across 3 rounds.

Despite the cooldown, the numbers underscore a steady confidence in MENA’s scaling startups, especially as mega-rounds and cross-border investors continue to define the region’s growth story.

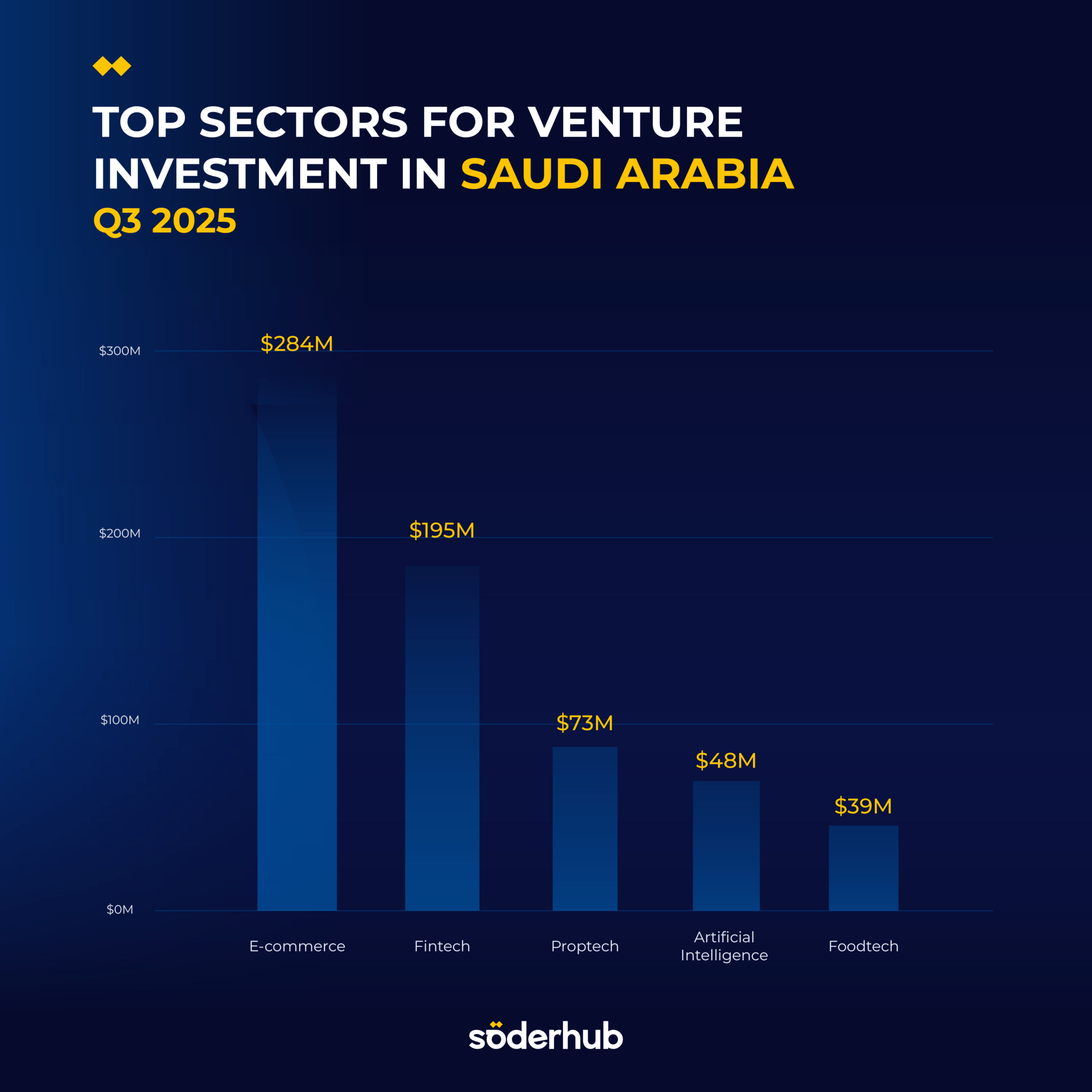

Here are the most attractive sectors for venture investment in Saudi Arabia: e-commerce leads with $284M, followed by fintech and proptech.

MENA IPOs hit $700M in Q3, Saudi takes the lead

MENA IPO activity in Q3 2025 was driven by real estate, healthcare, retail, and industrials, which together delivered a 120% YoY surge to $700M across 11 listings. Momentum is supported by regulatory reforms and growing investor interest, highlighting the region’s increasingly diverse and liquid public markets.

Saudi Arabia draws global interest in insurance and reinsurance

Saudi Arabia’s insurance and reinsurance market is booming, attracting foreign players with a strong regulatory framework and digital infrastructure. The market grew 17% in 2024, premiums are set to double by 2030, and initiatives like Riyadh

Riyadh Reinsurance Co., officially launched at the Global Insurance Conference, is entering the market with $146.6M capital, aiming to reach $213M in four years and targeting a 60/40 split between local and international markets initially. CEO Fahd Al-Husni highlighted that Saudi Arabia’s reinsurance market could reach $5.3B by 2030, attracting global companies, while other insurers like the Co. for Cooperative Insurance await regulatory approval to expand into reinsurance.

Saudi economy posts 80% growth since Vision 2030 launch

Saudi Arabia’s economy has grown 80% since the launch of Vision 2030 in 2016, Minister of Investment Khalid Al-Falih announced, despite oil price fluctuations.

Foreign direct investment surged to $32B annually, up from $5–8B, with a target to increase tenfold by 2030.

Regional HQs of international companies in the Kingdom now number 670, expected to exceed 700 within a year.

Total investment in the economy increased from 22% to 30% of GDP, while the private sector’s share of this investment climbed from 60% to 76%.

Women’s participation in the workforce rose to 43.5%, reflecting the success of Vision 2030 empowerment programs.

Al-Falih emphasized that Saudi Arabia is accelerating toward Vision 2030 goals by enhancing the investment environment, expanding private sector partnerships, and attracting quality global investments.

Monsha’at and the Swedish Trade Council agree on closer collaboration

On the sidelines of Biban 2025, Monsha’at signed an MoU with the Swedish Trade and Investment Council to connect Saudi startups with Swedish incubators and accelerators, and enhance entrepreneurship education. The partnership leverages Sweden’s experience in simulation-based programs and supports Vision 2030’s goal of a thriving, knowledge-based economy. Deals at the forum have already exceeded $5.87 billion.

Merak Capital backs Arsann with $26.7M to fuel growth

Merak Capital invested $26.7M in Arsann to expand its IoT-enabled smart parking solutions. Currently, Arsann software is deployed in 270+ sites serving 10M vehicles, reducing congestion and optimizing parking flow.

Interested in exploring where your company could gain traction across the MENA region?

Söderhub News

We’ve attended FII9 in Riyadh and here’s why you should consider going next year

The ninth edition of the Future Investment Initiative (FII9) concluded in Riyadh on October 30, 2025. Our CEO, Magdy Shehata, had the pleasure of attending this highly selective invite-only gathering and is sharing his thoughts here.

For European investors and policymakers accustomed to the annual pilgrimage to Davos, FII deserves closer attention, not as a replacement, but as an increasingly important complement to traditional Western-centric gatherings.

The EU AI Act: what businesses need to know in 2025

The EU Artificial Intelligence Act, adopted in June 2024, is the world’s first comprehensive legal framework for AI, setting a global benchmark for trustworthy, safe, and human-centric AI.

The regulation has officially come into force, meaning companies must now strengthen the security of their AI systems, classify risk levels, and implement continuous monitoring across development, operation, and third-party agreements.

While full implementation is expected by mid-2026, 2025 is the critical year to act. The Act also introduces measures to help SMEs and startups adapt, offering guidance to build their compliance roadmaps early.

Would you like to learn more? Check out our article ⤵️

EVENTS ON OUR RADAR

Malmö, Sweden

18-19 November 2025

One of Europe’s leading gathering of impact investors and capital providers to accelerate funding for people and planet, forge key connections, and spotlight the Nordic impact ecosystem.

Slush

Helsinki, Finland

19–20 November 2025

One of the world’s top startup events. Curated crowd of founders, operators, VCs, and media. 13,000+ participants.

Helsinki, Finland

11–12 February 2026

Where business meets entrepreneurship. Join startups, investors, and leaders in Stockholm, the Nordic innovation hub.

Did a friend forward you this newsletter? Subscribe now!